ADDITIONAL INVENTORY OFFERS LITTLE RELIEF FOR BUYERS

February brought additional inventory to the table in the Vancouver Island Real Estate Board (VIREB) area. However, listings are still far below where they need to be to satisfy buyer demand.

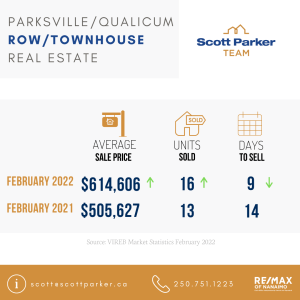

Active listings of single-family homes were 12 per cent lower last month than the previous February but rose by 34 per cent from January 2022. VIREB’s inventory of condo apartments in February declined by 31 per cent from one year ago but increased by seven per cent from the previous month. Row/townhouse inventory dropped by 27 per cent year over year but was the same as in January (66).

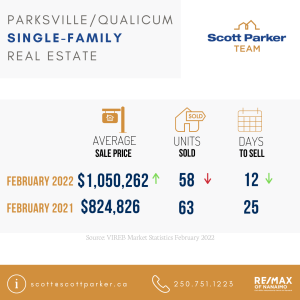

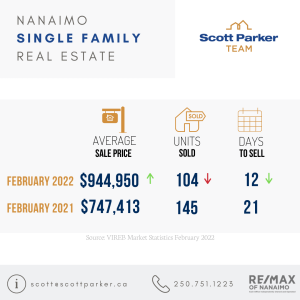

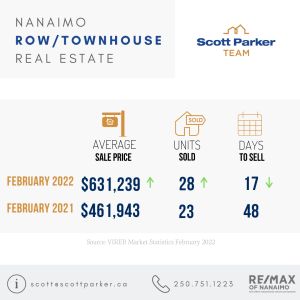

By category, 360 single-family homes sold on the MLS® System in February, a 13 per cent decrease from one year ago and up by 64 per cent from January. There were 112 condo apartment sales last month compared to 128 one year ago, a decline of 13 per cent year over year but a 23 per cent increase from the previous month. In the row/ townhouse category, 91 units sold in February compared to 79 one year ago and 61 in January, an increase of 15 and 49 per cent, respectively.

The British Columbia Real Estate Association (BCREA) says that with housing markets so out-of-balance, it will take a substantial decline in demand to return active listings to a healthy state. A “perfect storm” of factors – including record-low supply, historically low mortgage rates, and lifestyle changes resulting from the COVID-19 pandemic – have resulted in dramatic price increases and highly competitive real estate transactions.

“British Columbia is in the midst of a housing crisis,” says Erica Kavanaugh, 2022 VIREB President. “Organized real estate has data-driven insights into potential solutions, which is why BCREA just released a white paper on market conditions in the province.”

In a Better Way Home: Strengthening Consumer Protection in Real Estate, BCREA presents over 30 recommendations to the provincial government on how it can protect consumers today and provide affordable housing in the future. Using extensive data and expert analysis, BCREA focuses on real-life solutions in the paper instead of ineffective and temporary demand-side fixes, adds Kavanaugh. (To read or download the white paper, visit bcrea.bc.ca/whitepaper.)

“The price of a home is primarily driven by the market fundamentals of supply and demand,” says Kavanaugh. “Government interventions that only target the transaction process, such as the recently announced cooling-off period, will never be enough to make housing more affordable. The bottom line is that we need more supply.”

The principles of supply and demand are certainly fuelling VIREB’s upward trajectory of house prices. The board- wide benchmark price of a single-family home reached $822,500 in February, up 36 per cent year over year. In the apartment category, the benchmark price hit $415,000 last month, a 28 per cent increase from February 2021. The benchmark price of a townhouse increased by 34 per cent, climbing to $635,000 in February.

Benchmark Price

Price increases are even more dramatic in some of VIREB’s regions. For example, the cost of a benchmark single- family home in

- Nanaimo’s benchmark price rose by 38 per cent, reaching $852,800

- Port Alberni reached $569,800, a 53 per cent year-over-year increase

- North Island, the benchmark price of a single-family home rose by 50 per cent to $438,100

- Campbell River, the benchmark price of a single-family home hit $699,900 in February, up by 28 per cent from the previous year

- Comox Valley, the year-over-year benchmark price rose by 30 per cent to $820,600

- Cowichan Valley reported a benchmark price of $804,300, an increase of 29 per cent from February 2021

- Parksville-Qualicum area saw its benchmark price increase by 40 per cent to $962,200

In the Loop: February 2022 Real Estate Market Stats

For more information or questions on buying or selling your home, Contact: The Scott Parker Team

Email: service@scottparker.ca Phone: 250-751-1223

Original Source: VIREB