Additional inventory is positive news for buyers. Inventory in the Vancouver Island Real Estate Board (VIREB) area is climbing, but the housing supply is still far below the level needed to satisfy current demand.

Active listings of single-family homes rose by 34 per cent from April 2021 and by 32 per cent from March of this year. VIREB’s inventory of condo apartments was 13 per cent lower than in April 2021 but increased by 18 per cent from March. Row/townhouse inventory rose by 39 per cent year over year and 52 per cent from March.

A “perfect storm” of factors – including record-low supply, historically low mortgage rates, and lifestyle changes resulting from the COVID-19 pandemic – has fuelled dramatic price increases and highly competitive real estate transactions. However, REALTORS® have noticed that current demand is not equally distributed throughout VIREB’s zones, resulting in “micro-markets.” These pockets of heightened activity favour particular price points and property types within an area.

Demographics also play a significant role in British Columbia’s robust housing market. A large contingent of 30-39-year-olds – the largest we have seen in Canada since the 1970s – are entering their homebuying years. Intergenerational wealth transfer is helping many get onto or climb the property ladder, placing additional pressure on inventory and prices.

The increased inventory observed in April is positive news for buyers, and some REALTORS® are seeing more conditional offers, indicating that the “fear of missing out” has abated somewhat. Higher interest rates may also be tempering how much buyers are willing to spend when making an offer. However, it is too early to say whether conditions are beginning to shift towards a more balanced market. According to the British Columbia Real Estate Association, housing markets in British Columbia are so lopsided that it will take a substantial decline in demand to return active listings to a healthy state.

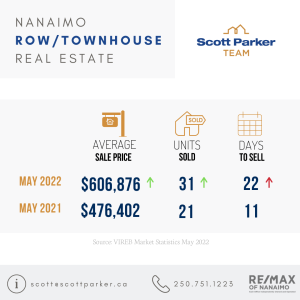

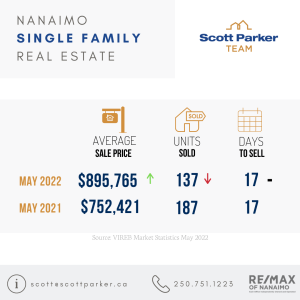

That said, sales did dip in April. By category, 507 single-family homes were reported sold on the MLS® System in April, a 13 per cent decrease from one year ago and down by three per cent from March. There were 114 condo apartment sales last month, a decline of 11 per cent year over year and down by six per cent from March. In the row/townhouse category, 96 units changed hands in April, down nine per cent from one year ago and nine per cent from March 2022. However, the cause behind these decreases is somewhat muddy: whether the numbers reflect “true” decreased demand or merely supply-induced buyer fatigue should become more apparent in the coming months.

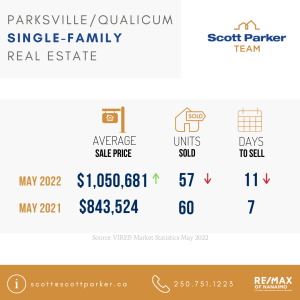

As for prices, they continue to rise throughout the VIREB area. The board-wide benchmark price of a single-family home reached $881,800 in April, up 34 per cent year over year. In the apartment category, the benchmark price hit $462,100 last month, a 34 per cent increase from April 2021. The benchmark price of a townhouse increased by 29 per cent, climbing to $657,300 in April.

Benchmark Pricing

- Nanaimo’s benchmark price rose by 33 per cent, reaching $907,600

- Campbell River, the benchmark price of a single-family home hit $769,800 in April, up by 31 per cent from the previous year

- Comox Valley, the year-over-year benchmark price rose by 27 per cent to $878,400

- Cowichan Valley reported a benchmark price of $871,900, an increase of 36 per cent from April 2021

- Parksville- Qualicum area saw its benchmark price increase by 38 per cent to $1,027,000

- Port Alberni reached $615,200, a 46 per cent year-over-year increase

- North Island, the benchmark price of a single-family home rose by 39 per cent to $437,400